Current Environment in Venture Capital

Where is the venture capital market compared to historical levels? How many companies are securing funding and in what industries? Below are data and commentary regarding the venture capital environment both nationally and within Texas. Aristos Ventures maintains historical information that has been provided by PwC’s Moneytree and the National Venture Capital Association (NVCA). The charts below are excerpted from a larger presentation around current topics in venture capital that Aristos Ventures produces for select audiences.

|

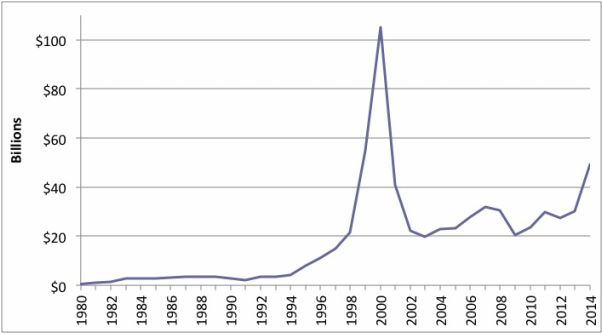

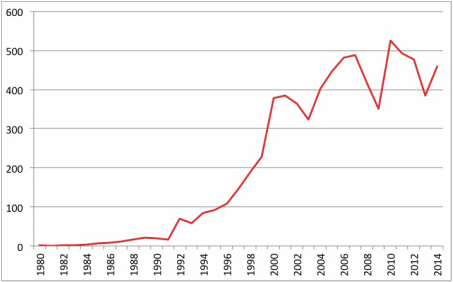

Chart 1 to the left displays the amount of dollars invested by venture capital firms into companies since 1980. The obvious outlier is the dot com era of the late 1990s. It seems as though the amount of money invested by venture capital firms accelerated in 1995, perhaps because of the Netscape IPO and the start of the commercialization and accessibility of the Internet. Total dollars invested had a marked upswing in 2014 to levels not seen since 2000. A possible explanation for 2014 could be the large rounds in late stage companies like Uber, Dropbox, Airbnb, and others.

|

|

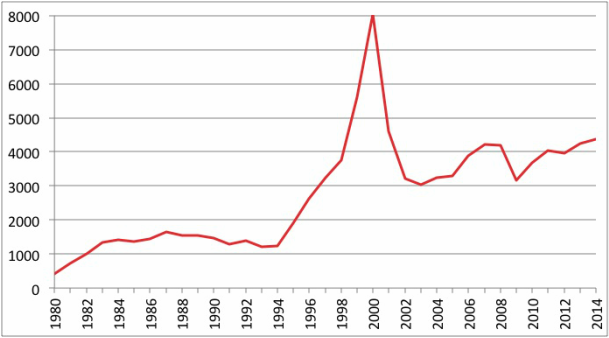

Per Chart 2, the number of companies invested by venture capital firms is trending upward, but not at an alarming rate (Chart 1). It seems as though the growth rate is sustainable. The number of companies funded tracks the amount of money invested by VC firms (Chart 1) until recently. Not shown is that quarterly venture capital investment declined for the first quarter of 2015 by 10 percent in terms of dollars and 8 percent in the number of deals, compared to the fourth quarter. |

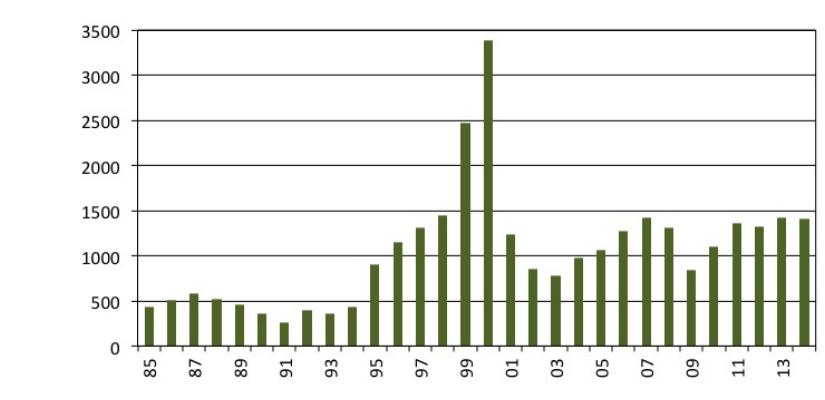

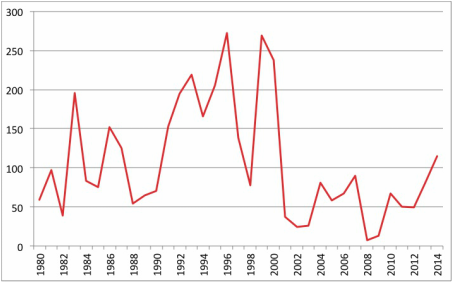

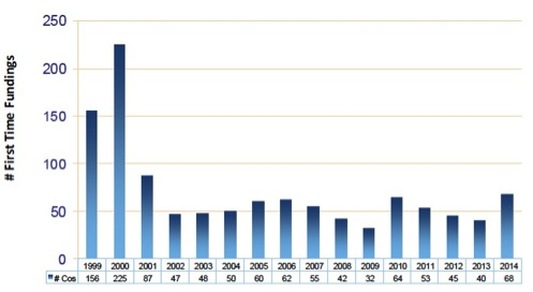

Chart 3 above denotes first time fundings by venture capital firms into new companies. 1,409 companies received first time funding in 2014, which is trending upward. There seems to be, at least in the last twelve years, a cyclical nature to first time fundings. There are about 800 venture capital firms in the US employing 5,600 professionals. Each partner at a firm invests, on average, in 1 to 1.5 companies per year (2 to 3 every two years). A rule of thumb is that 1 in 100 companies receive funding, but that figure may actually be closer to 1 in 300 or more.

First-time financing dollars decreased 30 percent to $1.8 billion in Q1 (2015) while the number of deals was down 18 percent from the prior quarter, dropping to 305. First-time financings accounted for 14 percent of all dollars and 30 percent of all deals in the first quarter of 2015.

First-time financing dollars decreased 30 percent to $1.8 billion in Q1 (2015) while the number of deals was down 18 percent from the prior quarter, dropping to 305. First-time financings accounted for 14 percent of all dollars and 30 percent of all deals in the first quarter of 2015.

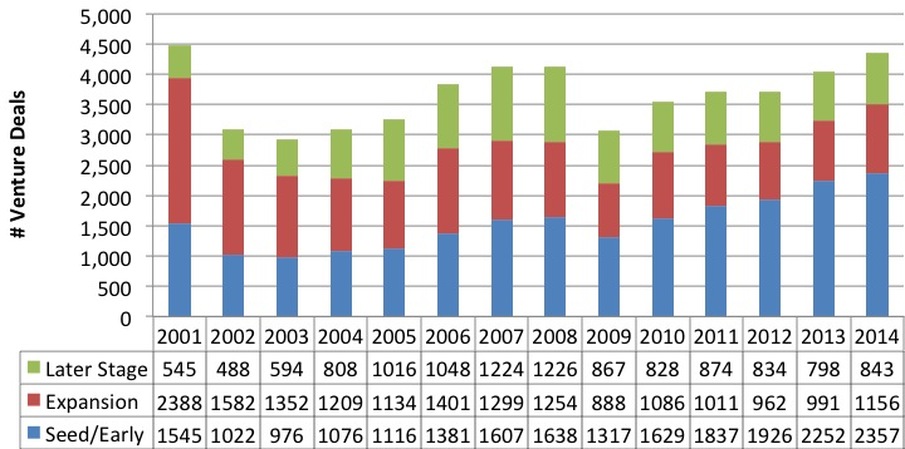

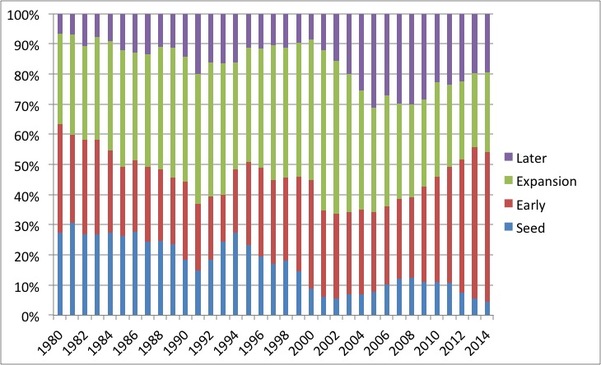

Seed and Early Stage lead the number of companies receiving venture funding of any kind with over half. While good overall for Aristos Ventures as the numbers of companies the firm focuses on was robust, there is a concern that new players in the market such as accelerators, incubators (see this link), some co-working spaces, family offices, non-accredited individuals (per the JOBS Act) and angel groups, may oversaturate the market. Over time, companies funded by non-institutional firms will fail, and a declaration that early stage investing does not work may be determined by some vocal investors. This is not an immediate concern but a horizonal one. Aristos Ventures tends to wait and watch (let the experiment run) these companies that are seeded by the groups previously mentioned and “skim the cream”. As was discussed two years ago during fund raising, the time for early stage investing has not been better than it is now, as long as a disciplined, thematic, and diligent approach is followed.

|

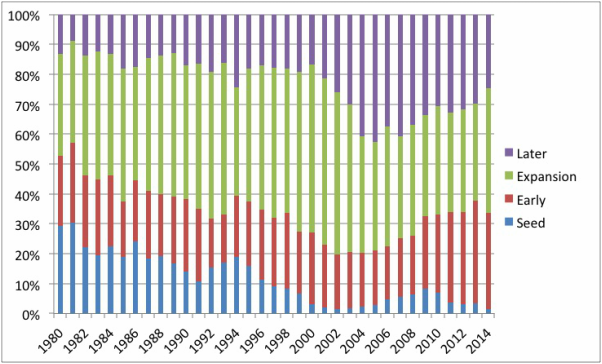

The amount of money shown in Chart 5 as a percentage of each stage further enforces the idea discussed in Chart 1, with expansion stage companies receiving the bulk of venture capital dollars. Not shown is that for the first quarter of 2015, the software industry continued to receive the highest level of funding of all industries, despite being down for the quarter. |

|

The greatest number of companies that received venture funding was in the early stage round, with more than 50% of companies in seed and early stage. Not since 1996 have the number of companies been greater than 50% and not since the mid 1980s has this happened more than two years in a row. This, again, is a positive for Aristos Ventures as the firm focuses on early stage companies. Seed is trending downward perhaps because individual investors are entering the market via crowd funding or other means. |

For the first quarter of 2015 (not shown), seed stage investment was down 32 percent in dollars and 35 percent in deals with $126 million invested into 26 deals, the lowest quarterly deal count since the MoneyTree began tracking VC investments in 1995. Again, this could be due to individual investors are entering the market via crowd funding or other means.

|

The IPO market for venture backed companies is struggling with just 81 in 2013 and 115 in 2014. Studies show that about 140 venture capital back IPOs should come to market each year. 2008 was a tumultuous year for many reasons one of which is that just 8 VC backed companies went public. Not a concern for Aristos Ventures as the strategy for the portfolio companies is to be acquired. |

Texas Statistics

|

68 Texas companies that received first time funding in 2014, the highest level since 2001. This matches well with the national trend in Chart 3, however, Texas had just 4.8% of the companies that received first time funding rounds. There could be several theories on why this is: macroeconomic (state wide), microeconomic, lack of start-ups, dearth of capital, paucity of quality (companies and capital), a combination, or other unknown forces. |

Chart 11 displays the percentage of venture capital dollars invested in first time fundings in Texas by industry. Software received the most dollars which is favorable to Aristos Ventures as software companies are very capital efficient (i.e. a team with laptops can create a “good” software company).

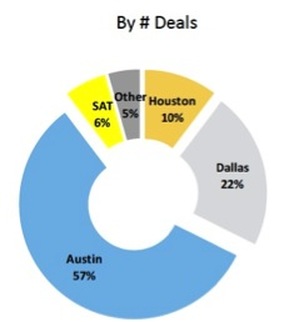

Chart 12 shows the location of first time fundings in Texas with Austin still a hotbed of entrepreneurs. This fact has been a topic of conversation for a multitude of years. Dallas has a large number of corporate headquarters located in the metroplex as well as technology "neighborhoods" like Richardson/Plano telecom corridor, semiconductor companies Texas Instruments and Maxim, defense Raytheon, Lockheed Martin, to name a few. Why does Austin have a large number of startups? Is it the number of investors, a tier 1 research university, small geographic area, younger demographic, liberal nature, weather, or one/all/none of the above? Perhaps more money that is made in technology companies stays in the area (Dell, Trilogy, AMD, IBM, Motorola/Freescale) and people coming out of those companies found and fund startups. A similar thesis could hold true for Silicon Valley.

Chart 12 shows the location of first time fundings in Texas with Austin still a hotbed of entrepreneurs. This fact has been a topic of conversation for a multitude of years. Dallas has a large number of corporate headquarters located in the metroplex as well as technology "neighborhoods" like Richardson/Plano telecom corridor, semiconductor companies Texas Instruments and Maxim, defense Raytheon, Lockheed Martin, to name a few. Why does Austin have a large number of startups? Is it the number of investors, a tier 1 research university, small geographic area, younger demographic, liberal nature, weather, or one/all/none of the above? Perhaps more money that is made in technology companies stays in the area (Dell, Trilogy, AMD, IBM, Motorola/Freescale) and people coming out of those companies found and fund startups. A similar thesis could hold true for Silicon Valley.

Chart 13 data is from the National Venture Capital Association and Cambridge & Associates. Venture capital has historically performed well in relationship to other asset classes. Venture capital has a high financial alpha (α), and can lead to outsized gains.

Early stage venture investing continues to be a viable asset class with the potential to generate substantial returns for investors, entrepreneurs, and employees. Texas in particular is well suited for entrepreneurs, especially with the recent build up of the start-up "ecosystem". Venture capital investing is very much an apprenticeship business, but with the recent legislative changes, anyone can invest. The hard part is not making an investment in an early stage company. The hard part is determining which companies have the potential to be successful and have investors that can shepherd them around the track, helping with predictable surprises. The default outcome for any start-up is failure or entropy. Venture investors must have the fortitude to mange them through the downturns, financially and operationally, and empower entrepreneurs toward success.

If you have any questions or need any additional information, please call me directly at (214) 306-9554.

Follow Aristos Ventures for updates and interesting information here:

http://www.linkedin.com/company/aristos-ventures

https://www.facebook.com/AristosVentures

http://www.crunchbase.com/financial-organization/aristos-ventures

Early stage venture investing continues to be a viable asset class with the potential to generate substantial returns for investors, entrepreneurs, and employees. Texas in particular is well suited for entrepreneurs, especially with the recent build up of the start-up "ecosystem". Venture capital investing is very much an apprenticeship business, but with the recent legislative changes, anyone can invest. The hard part is not making an investment in an early stage company. The hard part is determining which companies have the potential to be successful and have investors that can shepherd them around the track, helping with predictable surprises. The default outcome for any start-up is failure or entropy. Venture investors must have the fortitude to mange them through the downturns, financially and operationally, and empower entrepreneurs toward success.

If you have any questions or need any additional information, please call me directly at (214) 306-9554.

Follow Aristos Ventures for updates and interesting information here:

http://www.linkedin.com/company/aristos-ventures

https://www.facebook.com/AristosVentures

http://www.crunchbase.com/financial-organization/aristos-ventures